Tax Rates & Allowances

Back to Tax Rates & AllowancesCorporation Tax

Rates

The rates for today and for the past few years are as follows:

| Year beginning 1 April: | 2021 | 2022 | 2023 | 2024 | 2025 |

| Corporate Tax main rate | 19% | 19% | 25% | 25% | 25% |

| Corporate Tax small profits rate | N/A | N/A | 19% | 19% | 19% |

| Marginal relief lower profit limit | N/A | N/A | £50,000 | £50,000 | £50,000 |

| Marginal relief upper profit limit | N/A | N/A | £250,000 | £250,000 | £250,000 |

| Standard fraction | N/A | N/A | 3/200 | 3/200 | 3/200 |

| Main rate (all profits except ring fence profits) | 19% | 19% | N/A | N/A | N/A |

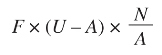

From 1 April 2023, the Corporation Tax main rate applies to profits over £250,000, and the small profits rate applies to profits of up to £50,000. Those thresholds are divided by the number of associated companies carrying on a trade or business for all or part of the accounting period. Companies with profits between £50,000 and £250,000 pay tax at the main rate reduced by a marginal relief determined by the standard fraction and this formula:

Where:

F = standard fraction

U = upper limit

A = amount of the augmented profits

N =amount of the taxable total profits

For companies with ring fence profits from oil or gas related activities, the main rate is 30%, and the small profits rate is 19%, with a ring fence fraction of 11/400. This has applied for all financial years from 2008.

Research and Development (R&D)

R&D Tax Relief – Rules for 2025/26

From 1 April 2024, a new merged R&D scheme replaced the previous SME and RDEC schemes for most companies. However, a modified SME scheme — called Enhanced R&D Intensive Support (ERIS) — remains available for R&D-intensive, loss-making SMEs as of April 2025.

The Merged Scheme

- Applies to most companies for accounting periods starting on or after 1 April 2024.

- Offers a 20% taxable expenditure credit on qualifying R&D costs.

- Available to companies within the charge to UK Corporation Tax with R&D projects aimed at advancing science or technology.

- The qualifying expenditure rules remain similar to the old schemes, covering staffing, software, consumables, utilities (excluding rent), and subcontracted R&D under certain conditions.

Enhanced R&D Intensive Support (ERIS)

- Available to loss-making SMEs that spend at least 40% of total costs on qualifying R&D.

- Allows a total deduction of 186% (100% base + 86% enhancement).

- Offers a non-taxable payable credit worth up to 14.5% of the surrenderable loss.

Companies cannot claim both ERIS and the merged scheme for the same expenditure but can choose between them if eligible.

Schemes for Periods Starting Before 1 April 2024

SME Scheme

Provided a 230% deduction before April 2023; reduced to 186% from April 2023.

Loss-making SMEs could surrender losses for:

- 10% credit generally

- 14.5% if R&D-intensive (?40% spend on R&D)

RDEC Scheme

For large companies or SMEs not eligible for the SME scheme.

Offered a 20% taxable credit on qualifying R&D spend.

R & D Summary

In conclusion, from 1 April 2024, the previous SME and RDEC schemes have been consolidated into a single R&D Tax Relief scheme for most companies, with the exception of the new Enhanced R&D Intensive Support (ERIS) scheme, which remains available for R&D-intensive, loss-making SMEs.

The key difference is that the merged R&D Tax Relief scheme now applies to most companies, whereas the Enhanced R&D Intensive Support (ERIS) scheme is specifically for R&D-intensive, loss-making SMEs, which was not the focus of the previous schemes.